kern county property tax rate 2021

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. More than 70 of all taxes collected is allocated to 120 governing boards of schools cities and special districts.

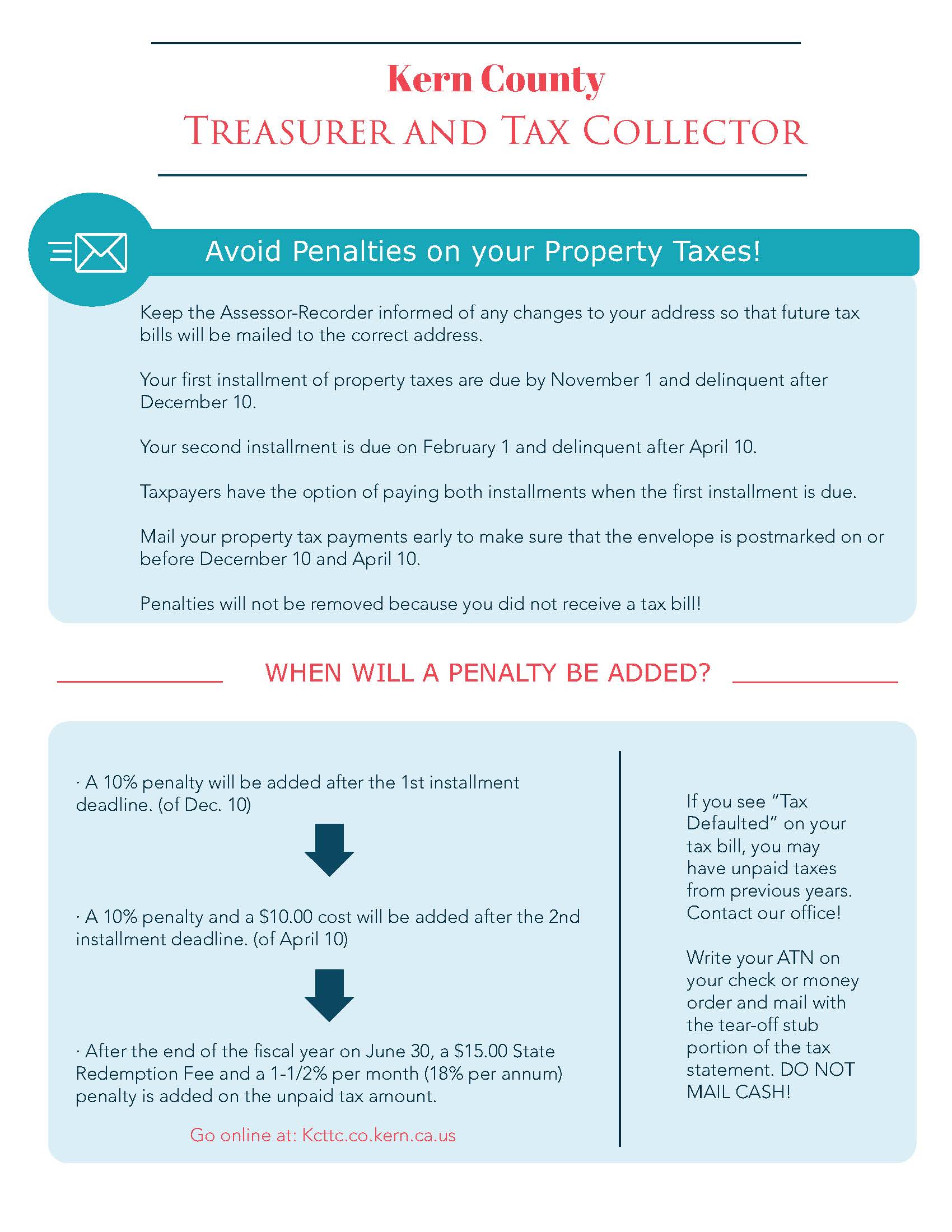

Kern County Treasurer And Tax Collector

800 AM - 500 PM Mon-Fri 661-868-3599.

. A 10 penalty plus 1000 cost is added as of 500 pm. Auditor - Controller - County Clerk. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

1115 Truxtun Avenue Bakersfield CA 93301-4639. Kern County CA Home Menu. The Treasurer-Tax Collector collects all property taxes.

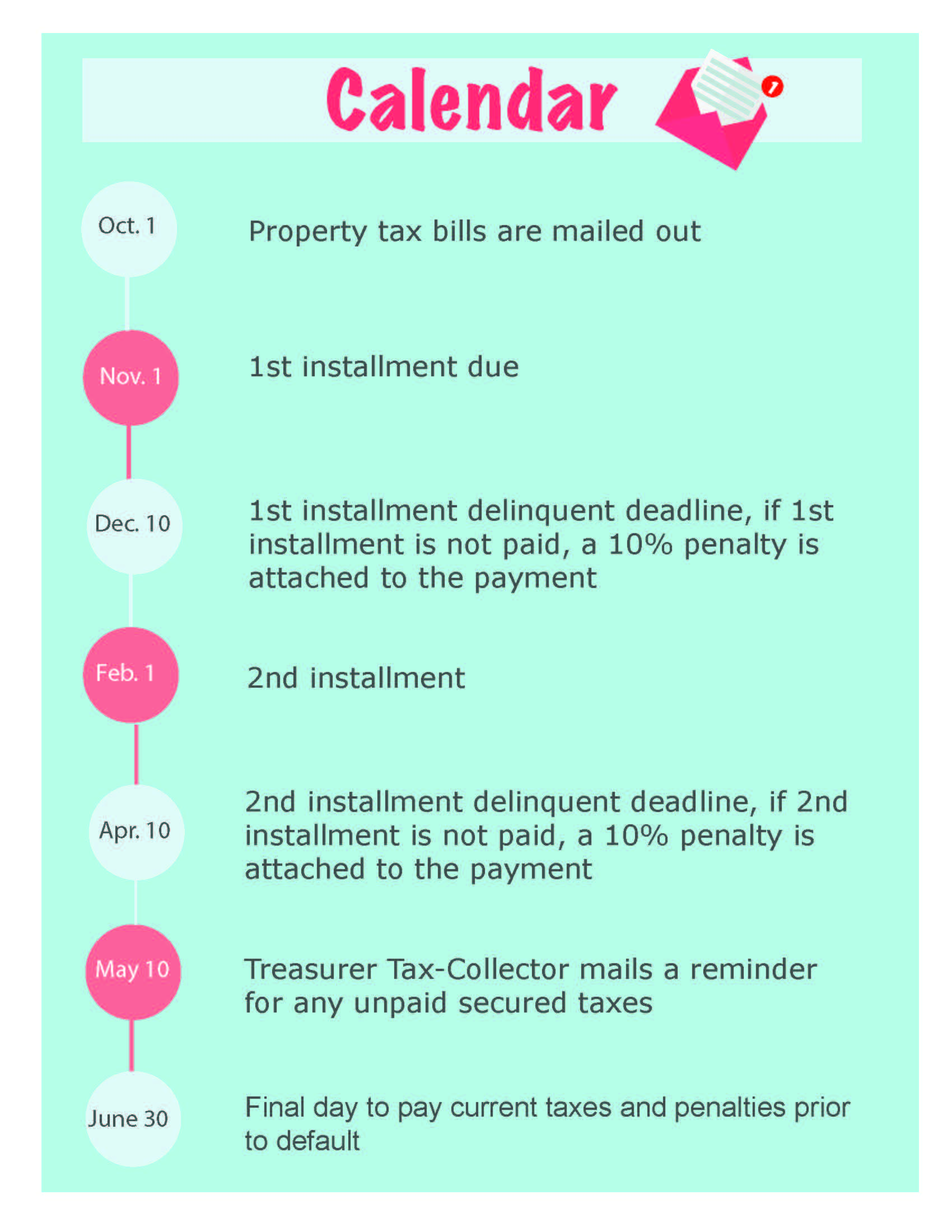

Kern County CA Home Menu. Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes. Tax Rates - Kern County Auditor-Controller-County Clerk.

2020-2021 Annual Property Tax Rate Book. 2019-2020 Annual Property Tax. Senate Bill 812 changed state law effective January 1 2018 by adding subdivision d to.

You have the right. Kern County real property taxes are due by 5 pm. Visit Treasurer-Tax Collectors site.

- a property owner cannot buy their own property at a tax sale for less than the taxes owed. 2019-2020 Annual Property Tax. The Kern County California sales tax is 725 the same as the California state sales tax.

1115 Truxtun Avenue Bakersfield CA 93301-4639. Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes. 2020-2021 Annual Property Tax Rate Book.

Información de Redistribución de Distritos del 2021. Información de Redistribución de Distritos del 2021. Auditor - Controller - County Clerk.

10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. That equates to about an 119 million increase in property tax revenue to the county which had been estimated at around 280 million for fiscal year 2021-22 allowing. Kern County CA Home Menu.

While many other states allow counties and other localities to collect a local option sales tax. A 10 penalty plus 1000 cost is added as of 500 pm. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County.

Auditor - Controller - County Clerk. Dec 8 2021. Start your career at the Kern County Sheriffs Office today.

Kern County collects on average 08 of a propertys assessed fair. 2021 Proposition 19 allows persons over 55. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Kern County Auditor Controller County Clerk

Gloria Dr California City Ca 93505 Realtor Com

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Is Bakersfield A Good Place To Live Ultimate Moving To Bakersfield Ca Guide Mentors Moving Storage

How Healthy Is Kern County California Us News Healthiest Communities

Kern County California Oil Gas Environmental Impact Report

Kern County Property Tax Payments Due December 10th

Kern County California Wikipedia

Kern County Treasurer And Tax Collector

Kern County Taxpayers Association Kern County Taxpayers Association

Latest News From Kern Valley Sun

Orange County Ca Property Tax Search And Records Propertyshark

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

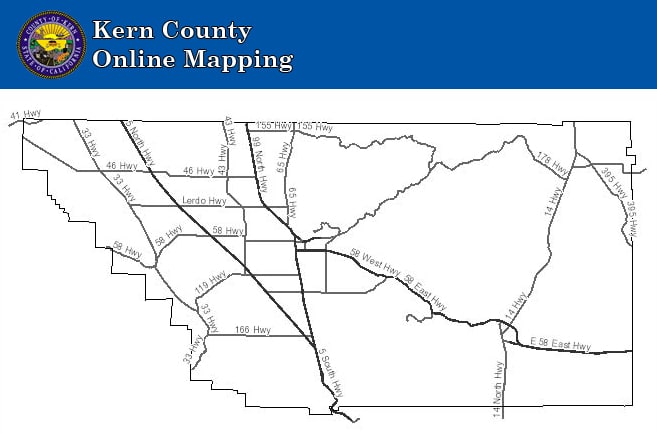

Interactive Maps Kern County Planning Natural Resources Dept

San Diego Property Taxes In California Prop 15